Content

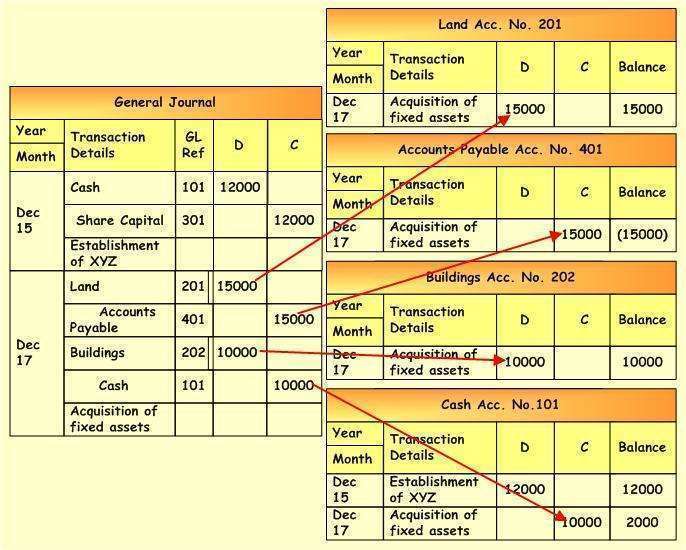

So you only impacted the left side of the accounting equation and kept the overall equation in balance. The double-entry system gives you a much more detailed view of your finances, and it does this through debits and credits. For now, know that every transaction should be recorded at least twice—once as a debit and once as a credit. Most businesses, even most small businesses, use double-entry bookkeeping for their accounting needs. Two characteristics of double-entry bookkeeping are that each account has two columns and that each transaction is located in two accounts. Two entries are made for each transaction – a debit in one account and a credit in another.

Bookkeepers record financial transactions as journal entries that increase or decrease the amount of money in different accounts, depending on the type of transaction. Accounting attempts to record both effects of a transaction or event on the entity’s financial statements. Without applying double entry concept, accounting records would only reflect a partial view of the company’s affairs. Imagine if an entity purchased a machine during a year, but the accounting records do not show whether the machine was purchased for cash or on credit. Perhaps the machine was bought in exchange of another machine.

The Basics Of Debits And Credits

He is the sole author of all the materials on AccountingCoach.com. Dummies has always stood for taking on complex concepts and making them easy to understand.

Who introduced double-entry?

The first known documentation of the double-entry system was first recorded in 1494 by Luca Pacioli, who is widely known today as the “Father of Accounting” because of the book he published that year detailing the concepts of the double-entry bookkeeping method.

Even the smallest business can benefit from double-entry accounting. The best way to get started with double-entry accounting is by using accounting software. Many popular accounting software applications such as QuickBooks Online, FreshBooks, and Xero offer a downloadable demo you can try. Double-entry accounting allows you to better manage business-related expenses. This shows the same transaction recorded using double-entry accounting. While your ledger gives you an idea of how much money is in your account, it does nothing to help you track your expenses, or know how much money your customers owe you. Unlike single-entry accounting, which requires only that you post a transaction into a ledger, double-entry tracks both sides of each transaction you enter.

The Accounting Cycle

Increase a liability or equity account, or decrease an asset account. Increase an asset account, or decrease a liability account or equity account (such as owner’s equity). Accountants call this the accounting equation, and it’s the foundation of double-entry accounting. If at any point this equation is out of balance, that means the bookkeeper has made a mistake somewhere along the way. In Example 3 given above, Lots of Fun Pty Ltd has increased expenses of $500 and simultaneously decreased cash assets of $500. Now let’s introduce to you a diagram that you must indelibly print into your brain!

Any increase in expense will be offset by a decrease in assets or increase in liability or equity and vice-versa. A general ledger is the record-keeping system for a company’s financial data, with debit and credit account records validated by a trial balance. Another example might be the purchase of a new computer for $1,000. In this example, you would need to enter a $1,000 debit to increase your income statement “Technology” expense account and a $1,000 credit to decrease your balance sheet “Cash” account. By following these three steps, and using the diagram given above, you will be able to determine whether each account is debited or credited. The double entry bookkeeping principle is really quite simple, but you must be sure to follow the above steps. Your job is to correctly record these transactions in the financial ledgers of the organisation.

Double Entry Accounting System

This is always the case except for when a business transaction only affects one side of the accounting equation. For example, if a restaurant purchases a new delivery vehicle for cash, the cash account is decreased by the cash disbursement and increased by the receipt of the new vehicle. This transaction does not affect the liability orequity accounts, but it does affect two different assets accounts. Thus, assets are decreased and immediately increased resulting in a net effect of zero.

- The accounting cycle begins with transactions and ends with completed financial statements.

- Bookkeepers choose the appropriate accounts for these entries from a list of the company’s accounts, called the chart of accounts.

- Can provide valuable insight into a company’s financial health.

- NerdWallet strives to keep its information accurate and up to date.

- Just as assets are on the left side of the accounting equation, the asset accounts in the general ledger have their balances on the left side.

- The double-entry system protects your small business against costly accounting errors.

One crucial fundamental principle is double-entry bookkeeping. A debit is always on the left side of the ledger, while a credit is always on the right side of the ledger. Get clear, concise answers to common business and software questions. Common stock is a type of security that represents ownership of equity in a company. There are other terms – such as common share, ordinary share, or voting share – that are equivalent to common stock.

Using Accounting Software

When failure is not an option, wise project managers rely on the power of statistical process control to uncover hidden schedule risks, build teamwork, and guarantee on-time delivery. Knowing the true cost of individual products and services, precisely, is crucial for product planning, pricing, and strategy. However, In some settings, traditional costing gives notoriously misleading estimates of these costs. As a resultl, many turn instead to Activity Based Costing for costing accuracy. Take control of asset TCO and prevent nasty cost surprises later. The financial hurdle rate event is familiar to nearly everyone in business seeking funding for projects, acquisitions, or investments.

Understanding General Ledger vs. General Journal – Investopedia

Understanding General Ledger vs. General Journal.

Posted: Sat, 25 Mar 2017 07:41:23 GMT [source]

Conversely, liabilities have a credit balance; they are increased by credits and decreased by debits. Each journal entry is shown in two columns in an accounting system, with the debits on the left and the credits on the right. Some transactions affect only one side of the accounting equation, but the double‐entry bookkeeping system nevertheless ensures that the accounting equation remains in balance. These two asset‐account entries offset each other, so the accounting equation remains in balance.

What Is Double Entry?

Find out what bookkeepers do, and get an intro to double-entry bookkeeping. These accounts ultimately filter down into your key financial reports. Successful branding is why fashions by Georgio Armani bring to mind style, exclusiveness, desirability. Branding is why riding Harley Davidson motorcycles makes a statement about the owner’s lifestyle. Strong branding ultimately pays off in customer loyalty, competitive edge, and bankable brand equity. Free AccessFinancial Modeling ProUse the financial model to help everyone understand exactly where your cost and benefit figures come from. The model lets you answer “What If?” questions, easily and it is indispensable for professional risk analysis.

- As you can see from the equation, assets always have to equal liabilities plus equity.

- The double entry system of accounting brings standardization across all the industries and companies which use it.

- Debits and credits are equal but opposite entries in your accounting books.

- Use our balance sheet template in Excel to track your assets and liabilities.

For those who need quality case results quickly—the complete concise guide to building the winning business case. For twenty years, the proven standard in business, government, and education.

The double-entry bookkeeping method is based on the idea that every business transaction has equal and opposite effects on at least double entry accounting examples two accounts. Double-entry bookkeeping is an accounting method where you equally record a transaction in two or more accounts.

So, we would then record Cash and place the amount, 30,000 on the debit column. You will learn how to prepare journal entries in another lesson. For a head start, let us take a look at how we came up with the journal entry for the first transaction. In that transaction, Mr. Briggs invested $30,000 to start a marketing consultation business on October 1, 2020. Liabilities in the balance sheet and income in the profit and loss account are both credits. So, if you buy something on credit, the amount is credited to the supplier’s account.

There are instances where one “account” works to offset the impact of another account in the same category. The so-called contra accounts “work against” other accounts in this way.

For each debit there is an equal and opposite credit and the sum of all debits therefore must equal the sum of all credits. This principle is useful for identifying errors in the transaction recording process.

When the company pays the bill from Checkers Sugar Supply, the bookkeeper will reduce accounts payable with a debit and reduce cash with a credit. Double-entry accounting is a bookkeeping system in which each transaction affects at least two accounts and maintains a balance between debits and credits. Companies of all sizes use double-entry accounting to run their businesses. The general ledger reflects a two-column journal entry accounting system. The company records on the debit side when a transaction causes an asset or expense account to increase.

Debit accounts are asset and expense accounts that usually have debit balances, i.e. the total debits usually exceed the total credits in each debit account. There are two different ways to record the effects of debits and credits on accounts in the double-entry system of bookkeeping. They are the Traditional Approach and the Accounting Equation Approach. Irrespective of the approach used, the effect on the books of accounts remains the same, with two aspects in each of the transactions. As the volume of transactions increases, this becomes more difficult. Double-entry accounting means that each journal entry affects at least two accounts and maintains a balance between debits and credits.

Author: Loren Fogelman

प्रतिक्रिया